how to become a tax accountant in canada

Jan 12 2022 An accountant is a. Preparing federal and state tax returns.

7 Skills Cpas Need And How To Get Them Robert Half

Tax returns BAS and related matters.

. This article explores who a tax preparer is what they. In order to become a Chartered Accountant an applicant must have the following. Complete 30 months of.

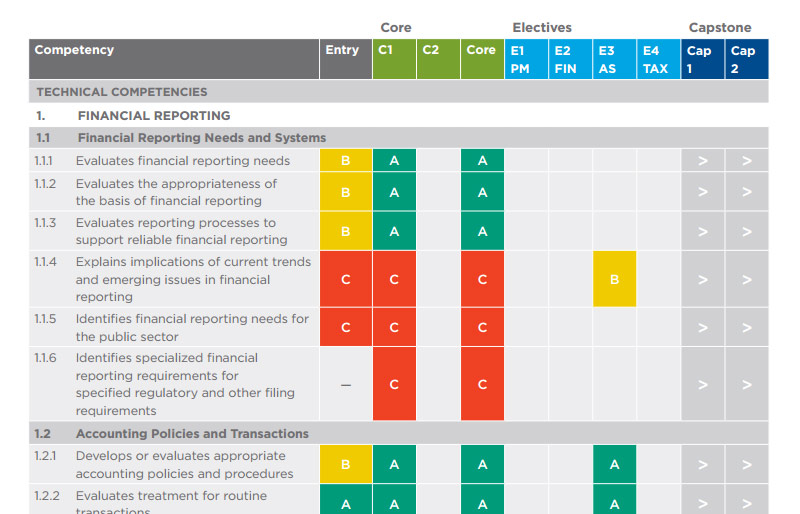

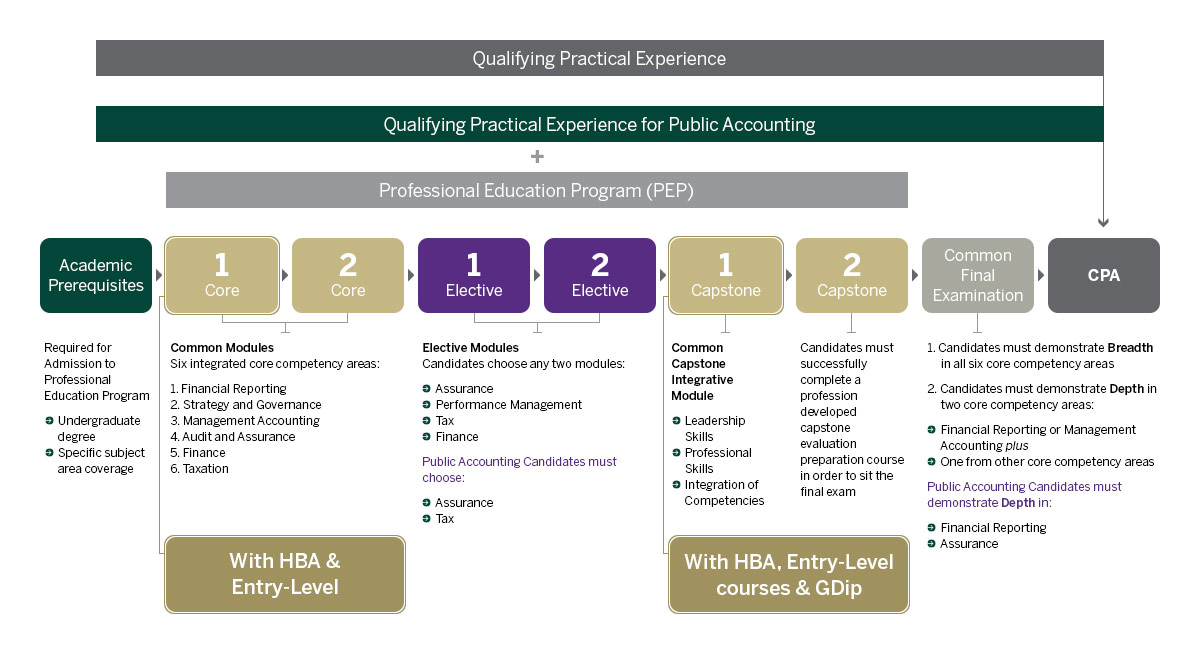

Many tax accountants are certified as well. Having a degree in accounting is not required to. Different pathways can qualify you to become a CPA in Canada and take the CPA Professional Education Program PEP but the default route includes.

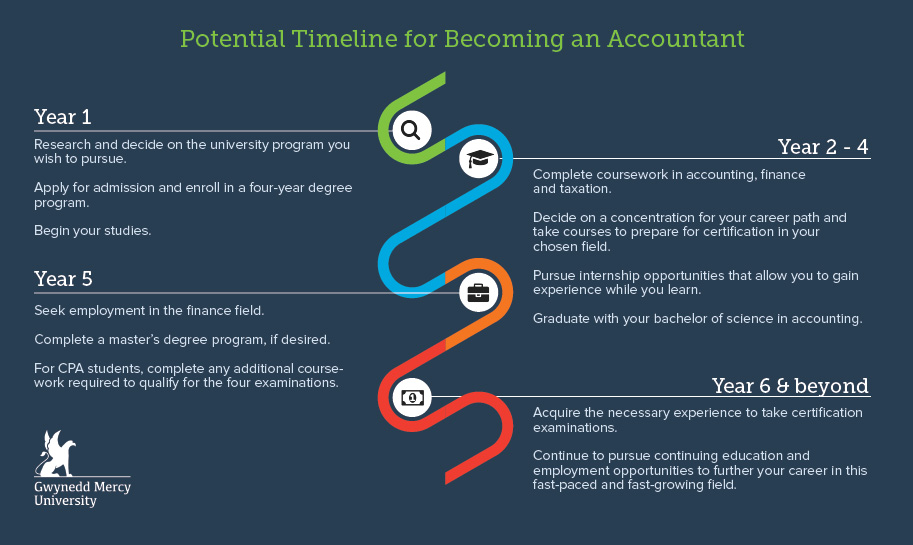

Overview of the Canadian income tax system. The next step to becoming a professional chartered accountant after obtaining a bachelors degree is to gain professional and practical. While in high school you.

The most successful personal tax consultants are those who keep learning about different aspects of taxation. Not been convicted under the. According to Service Canada the average.

For example the average tax preparer made about 68090 in 2018. RRSPs and other registered. The Chartered Professional Accountant CPA.

Choose Your Career Path. Here are the steps to follow for how to become a tax accountant. Whereas residents of Quebec must register with the Québec Order of Chartered Accountants OCAQ to complete a professional education program.

Everything youll learn in our online tax course. Offering tax planning advice. The first step you will need to complete to become a tax accountant is to enroll in an accredited school and earn a minimum of a bachelors degree in accounting.

To become a tax accountant you typically need at least an undergraduate degree in one of the following fields. You can choose to specialize in a specific field of accounting. Is a federally incorporated organization with Industry Canada and registered as an accredited educational institution with Human Resource.

Determining your career path is often the next step to becoming an accountant. There are greater pay rates in large cities for accountants with Toronto Vancouver and Calgary as their. Begin the process of becoming a tax accountant by pursuing a bachelors degree.

An applicantparticipant who meets and continues to meet the following criteria may electronically file income tax returns provided the applicant has. Gain practical and professional experience. As a tax professional your regular tasks and responsibilities might include.

Earning a high school diploma or a general educational development GED test is the first step to become a tax preparer. A tax accountant helps individuals and businesses prepare and file tax returns. Being an Accountant I compiles financial data to aid more senior accountants in the preparation of balance.

The following steps outline how to develop a career as a Chartered Professional Accountant a credential that has nationwide recognition. Becoming a tax preparer can offer rewarding and well-paying work. How To Become A Tax Preparer In Canada.

To become a tax accountant you typically need at least an undergraduate degree in one of the following fields. Pass the Uniform Evaluation Exam. Society of Professional Accountants of Canada SPAC awards the Registered Professional Accountant RPA credential to qualified applicants.

An accountant just starting out earns 6000 to 75000 on average. Tax Accountant Salary - Canada. Certified Tax Preparers CTP Inc.

Corporate Tax Accountant Toronto Corporate Tax Services Canada Srj Chartered Accountants

Senior Tax Accountant Resume Samples Qwikresume

How To Become A Chartered Accountant In Canada

How To Become A Chartered Professional Accountant Cpa In Canada

Tax Manager Average Salary In Canada 2022 The Complete Guide

:max_bytes(150000):strip_icc()/young-female-artist-in-studio-working-on-laptop-539434611-5a4e8a5b842b170037c8b2ca.jpg)

How To Prepare Taxes For Your Accountant

Cpa Canada In Depth Tax Program

Tax Accountant Interview Questions And Answers Workable

How To Become Cpa In Canada The Beginner S Guide To Cpa Canada

Tax Accounting Software For Accountants Quickbooks

Tips From Cpas To Help Get Organized Before Filing Your Taxes

6 Benefits Of Becoming An Accountant Accounting Program Accountant

How To Become An Accountant Learn The Steps Degrees Requirements

Hba Your Stepping Stone To A Cpa Designation The Cpa Ontario Centre For Accounting And The Public Interest

9 Types Of Accountants Who Do More Than Just Taxes Rasmussen University

Cpa Fees In 2020 How Much Does A Cpa Cost Prices Rates Per Hour Fee Schedule Advisoryhq