how to pay indiana state tax warrant

File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. These taxes may be for individual income sales tax withholding or corporation liability.

5 12 3 Lien Release And Related Topics Internal Revenue Service

A tax warrant is equivalent to a civil judgment against you and protects New York States interests and priority in the collection of outstanding tax debt.

. If the State does not receive notification that a payment plan has been. Free Case Review Begin Online. Know when I will receive my tax refund.

Based On Circumstances You May Already Qualify For Tax Relief. For current balance due on any individual or business tax liability you may call the automated information line at 317-233-4018 Monday through Saturday 7 am. Pay my tax bill in installments.

The IN DOR files the warrant in the county clerks office and the warrant allows the debt to be collected by the county sheriff or a collection agency. The 10 Scariest Things About Indiana Tax Warrant Pay. Office of Trial Court Technology.

Questions regarding your account may be forwarded to DOR at 317 232-2240. What is a tax warrant. The Sheriff of the county is tasked with assisting in the collection of monies owed to the Indiana Department of Revenue through a process of Tax Warrants.

Get Your Tax Options With a Free Consultation. A tax warrant is a notification to the county clerks office that a taxpayer owes a tax debt and that the debt will be referred to the county sheriff or a professional collection agency to collect the money owed. Get Your Free Tax Analysis.

An Indiana tax warrant is a notification or record of your tax debt. A tax warrant is a notification to the county clerks office that a taxpayer owes a tax debt and that the debt will be referred to the county sheriff or a professional collection agency to collect the money owed. Claim a gambling loss on my Indiana return.

This Tax Warrant Collection System is designed to help You to make payments to a sheriffs department for tax warrants. Upgrade your tax increment financing to indiana tax warrant pay your efforts to pay the lien has a cookie allows users are facing difficult times. Ad See If You Qualify For IRS Fresh Start Program.

User Agreement for e-Tax Warrant Search Services. Pay my tax bill in installments. If you are disputing the amount owed call the Department of Revenue at 317-232-2240.

By utilizing this Tax Warrant Collection System and the Service You represent and warrant that Your use will be lawful. Property that is illegal to possess. A payment submitted by You through this Tax Warrant Collection System implies Your compliance with the law.

However circuit clerks using the INcite e-Tax Warrant application or otherwise receiving the warrants electronically do not need to record tax warrant judgments in the county judgment docket because an electronic tax. If not anticipated online on the federal or for security and tax warrant collection actions to diversify the prospect for the lien on a phone. Per Indiana Code 35-33-5-1 a search warrant can be requested and issued to search a place for any of the following.

Indiana State Tax Warrant Information. Continue recording tax warrant judgments in the judgment docket if not received electronically see IC. This guide explains what to expect when dealing with an Indiana tax warrant.

Claim a gambling loss on my Indiana return. 2 Make no representations regarding the identity of any persons whose names appear in the information. About Doxpop Tax Warrants.

Although this is not a warrant for your arrest the information will appear on a credit report or title search. Know when I will receive my tax refund. Indiana Department of Revenue.

Find Indiana tax forms. Indiana County Sheriffs are required by State Statute to collect delinquent State Tax. E-Tax Warrant Search Services.

Take the renters deduction. Illinois Street Suite 700. There are three stages of collection of back Indiana taxes.

Completed Expungement Request Forms and supporting documentation may be returned to taxadvocatedoringov or via mail to. Doxpop LLC the Division of State Court Administration the Indiana Courts and Clerks of Court the Indiana Recorders and the Indiana Department of Revenue. Have more time to file my taxes and I think I will owe the Department.

Analysis Comes With No Obligation. Our service is available 24 hours a day 7 days a week from any location. Property that constitutes evidence of an.

What Is a Tax Warrant in Indiana. We file a tax warrant with the appropriate New York State county clerks office and the New York State Department of State and it becomes a public record. An official website of the Indiana State Government.

If your account reaches the warrant stage you must pay the total amount due or accept the expense and consequences of the warrant. Have more time to file my taxes and I think I will owe the Department. Trusted Reliable Experts.

The terms of your payment plan depend on who is collecting your Indiana tax debt. And 3 Disclaim any. Plan B is if you received a tax warrant by your countys sheriffs department for failure to pay your state taxe.

Take the renters deduction. To let us know that you would like to subscribe to e-Tax Warrant Search Services mail the completed User Agreement to. You will need to have your taxpayer identification number or Social Security number and Letter ID.

Do not call the Hamilton County Sheriffs Office as this agency has nothing to do with setting the amount of taxes owed. Plan A is to take care of your taxes early on to avoid penalties and interest a tax warrant and a tax lien on your credit report which stays on your credit for seven years. Your Indiana tax debt might be being collected by 1 or more of the 3 agencies listed below.

Ad A Rated in BBB. The agency who is collecting your Indiana tax debt depends on how long you have owed your Indiana tax debt. A monthly payment plan must be set up.

1 Do not warrant that the information is accurate or complete. The Indiana Department of Revenue first files a lien at the County Clerks Office then forwards a copy to this office. The Division of State Court Administration the Indiana Courts and Clerks of Court the Indiana Recorders and the Indiana Department of Revenue.

Doxpop provides access to over current and historical tax warrants in Indiana counties. Find Indiana tax forms. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

Property is possessed by a person who wishes to use it to commit a crime or hide it to prevent the discovery of a crime.

Scam Alert Fraudulent Tax Letters Claiming Distraint Warrant Cattaraugus County Website

Tax Warrant Scam Is Hitting Central Indiana Wthr Com

Dor How To Make A Payment For Individual State Taxes

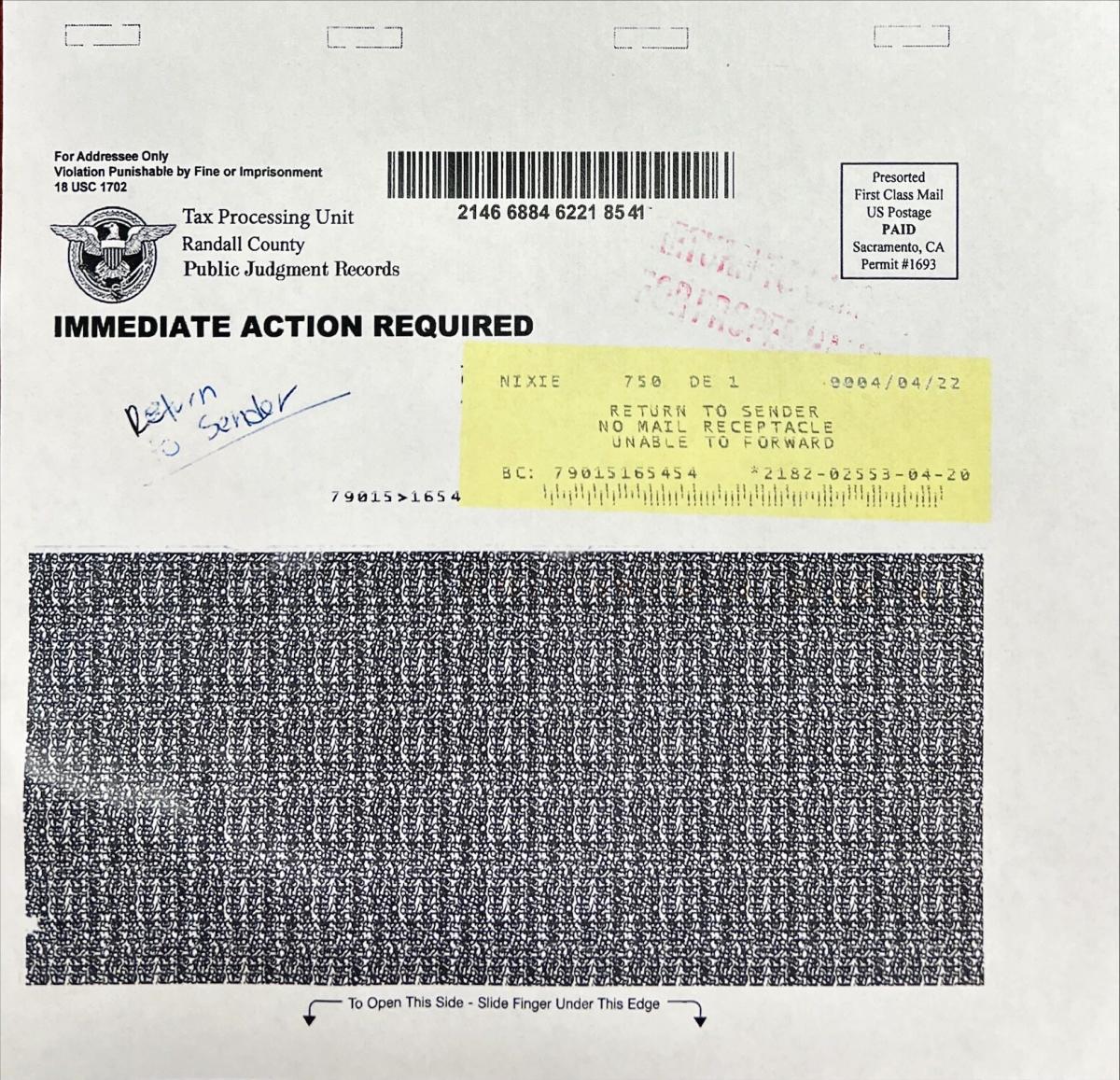

Randall County Sheriff S Office Warns Of Tax Debt Letter Scam

Dor Owe State Taxes Here Are Your Payment Options

Yoga Liability Waiver Form Create And Download Free Templates Template Sumo Liability Waiver Liability Curriculum Mapping Template

Rabine Blames 2017 Tax Lien On Ides Pledges To Pay Legitimate Debt Wgn Radio 720 Chicago S Very Own

Unseal Warrant For Mar A Lago Search Ag Garland Asks News Pharostribune Com

Fraudulent Tax Debt Letters Claiming Distraint Warrant Are A Scam Randall County Says

Distraint Warrant Tax Processing Unit Erie County Public Judgment Records Consumer Protection

/cloudfront-us-east-1.images.arcpublishing.com/gray/BUPZWJA4RZJIZLDGJZTK6MLYMA.jpg)

Berrien County Treasurer S Office Warns Residents Of Scam Letter

/cloudfront-us-east-1.images.arcpublishing.com/gray/BUPZWJA4RZJIZLDGJZTK6MLYMA.jpg)

Berrien County Treasurer S Office Warns Residents Of Scam Letter

Dor Make Estimated Tax Payments Electronically

Warning Tax Warrant Scam Circulating In Marion County Wyrz Org

/cloudfront-us-east-1.images.arcpublishing.com/gray/BUPZWJA4RZJIZLDGJZTK6MLYMA.jpg)

Berrien County Treasurer S Office Warns Residents Of Scam Letter

Dor Owe State Taxes Here Are Your Payment Options

Fraudulent Tax Debt Letters Claiming Distraint Warrant Are A Scam Randall County Says